If you are trying to understand the tariff regime imposed by President Trump last week, you may want to take a close look at his executive order promulgating it (along with Annexes I and II). The order imposes a flat 10 percent tariff on imports and then an additional tariff based on a formula keyed to a given country’s trade surplus with us.

AEI’s Kevin Corinth and Stan Veuger have gone a step further and looked at the formula published by the Office of the United States Trade Representative. Corinth and Veuger explain and comment on the tariff formula (below the break). If their analysis is correct, the formula inflates the “reciprocal” tariffs based on an error:

* * * * *

The formula for the tariffs, originally credited to the Council of Economic Advisers and published by the Office of the United States Trade Representative, does not make economic sense. The trade deficit with a given country is not determined only by tariffs and non-tariff trade barriers, but also by international capital flows, supply chains, comparative advantage, geography, etc.

But even if one were to take the Trump Administration’s tariff formula seriously, it makes an error that inflates the tariffs assumed to be levied by foreign countries four-fold. As a result, the “reciprocal” tariffs imposed by President Trump are highly inflated as well.

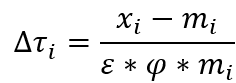

Though in effect the formula for the tariff placed on the United States by another country is equal to the trade deficit divided by imports, the formula published by the Office of the US Trade Representative has two additional terms in the denominator that just so happen to cancel out: (1) the elasticity of import demand with respect to import prices, ε, and (2) the elasticity of import prices with respect to tariffs, φ.

The idea is that as tariffs rise, the change in the trade deficit will depend on the responsiveness of import demand to tariffs, which depends on how import demand responds to import prices and how import prices respond to tariffs. The Trump Administration assumes an elasticity of import demand with respect to import prices of four, and an elasticity of import prices with respect to tariffs of 0.25, the product of which is one and is the reason they cancel out in the Administration’s formula.

However, the elasticity of import prices with respect to tariffs should be about one (actually 0.945), not 0.25 as the Trump Administration states. Their mistake is that they base the elasticity on the response of retail prices to tariffs, as opposed to import prices as they should have done. The article they cite by Alberto Cavallo and his coauthors makes this distinction clear. The authors state that “tariffs [are] passed through almost fully to US import prices,” while finding “more mixed evidence regarding retail price increases.” It is inconsistent to multiply the elasticity of import demand with respect to import prices by the elasticity of retail prices with respect to tariffs.

Correcting the Trump Administration’s error would reduce the tariffs assumed to be applied by each country to the United States to about a fourth of their stated level, and as a result, cut the tariffs announced by President Trump on Wednesday by the same fraction, subject to the 10 percent tariff floor. As shown in Table 1 [at the bottom of the Corinth/Veuger column], the tariff rate would not exceed 14 percent for any country. For all but a few countries, the tariff would be exactly 10 percent, the floor imposed by the Trump Administration.

(function(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//connect.facebook.net/en_US/all.js#xfbml=1&appId=154257474630565”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));

Source link