This story comes from the Telegraph and relates to the U.K. under its new Labour government, which has raised taxes, but you could write the same thing about pretty much any time and place. Capital was mobile 600 years ago, and it is still mobile today:

Fresh figures this week showed that the British Government is having to borrow more than expected, as tax income typically paid by the wealthiest has disappointed since the start of the year.

That is what always happens when you try to balance your budget on the already-overtaxed backs of the “rich.”

The list of wealthy non-doms and British business owners fleeing the UK is also growing longer by the day, with places such as Dubai, Italy and Greece mopping up Britain’s richest émigrés.

Last week, Richard Gnodde, Goldman Sachs’ most senior banker outside the US, and British billionaire brothers Ian and Richard Livingstone became the latest to shift their tax domicile outside the UK.

They join Egypt’s richest man, Nassef Sawiris, who co-owns Aston Villa Football Club. Steel magnate Lakshmi Mittal, whose family is worth £15bn, is expected to follow.

Advisers to wealthy global elites warn the chickens are coming home to roost after Reeves’s tax changes, and that efforts to scale back attacks on the wealthy have fallen short.

“Non-doms” are non-British citizens who live in the U.K., and until now were not taxed on their non-U.K. earnings.

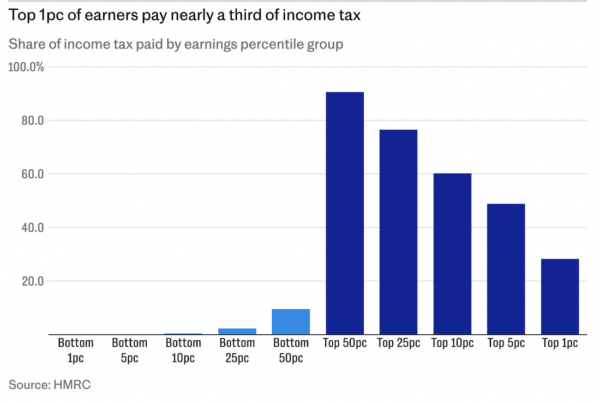

Upper-income taxpayers in the U.K. pay a disproportionate share of total income taxes. In fact, the percentage shares are eerily reminiscent of what we see in the United States:

Relying on only a relative handful of taxpayers can create problems:

“One of the consequences of tax revenue becoming more reliant on a smaller number of people is that it does make the public finances more vulnerable to the behaviour of that small number of people,” [Stuart Adam, of the Institute for Fiscal Studies] says.

The linked article documents the egress of wealthy residents from Britain in the wake of Labour’s tax increases, but it also echoes a point that was made in ground-breaking research by my organization at the state level: You can see the people who leave because of excessive taxes, but what you don’t see are the people who didn’t come to your jurisdiction in the first place:

Indeed, just as much of a concern is how many people would normally come that now won’t – a difficult thing to measure.

Exorbitant taxes drive out taxpayers that you already have, and deter new taxpayers from moving to your country or state. How can that possibly be surprising? And yet it is a lesson that liberals need to be taught, time after time, and still are somehow unable to absorb.