Dear Chuck,

I filed my taxes in such a hurry that I’m fearful I might have made a mistake and get audited. What happens if I get audited?

Fearful of the IRS

Dear Fearful of the IRS,

An audit is simply a closer inspection of your tax return. I was selected for a “spot audit” about 10 years ago. They wanted me to verify receipts for some of our charitable giving. It was nothing to fear. However, I did have a neighbor who wrote a series of letters to the White House and “claims” he got audited by the IRS shortly afterward. He says the audit revealed he owed Uncle Sam an additional $5 — a waste of time and money, but apparently, many such punitive audits were happening during that time.

Worry-free tax filing

If you were honest when filing, you should have a good conscience and nothing to fear.

“A good conscience is a continual Christmas” (Benjamin Franklin).

“There is no pillow as soft as a clear conscience” (John Wooden).

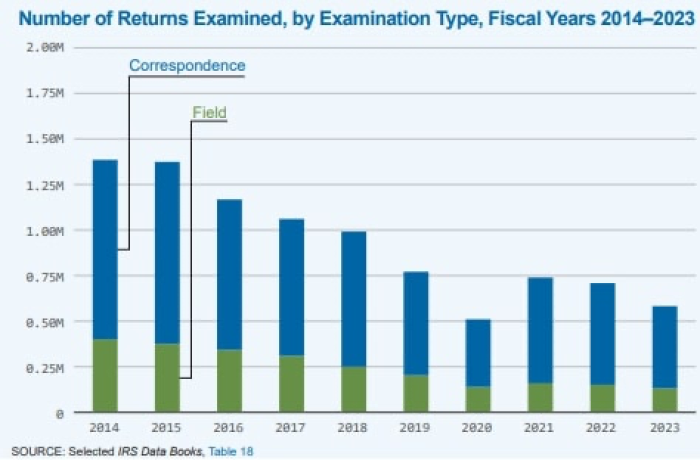

Audit rates are lower than most people think, and some believe they will drop even more due to cuts at the IRS. MarketWatch comments here. Below is one chart from this website that might be helpful to peruse. Most people end up paying more after being audited and correcting their filing.

USA Today reports that 3.8 out of every 1,000 returns were audited in 2022. An audit can be triggered if AI detects mismatched information, through random selection, via a connection to someone who is being audited, and for reported incomes that fall below $25,000 or above $500,000. Tax attorney Michael Steffanay says that in his experience, “the IRS concentrates its efforts on those items most likely to result in a large amount of additional tax due.” He notices that high net worth taxpayers and those with non-U.S. income and foreign entities receive primary attention.

Eric Scaringe, principal at CPA firm UHY, says that the easiest way to avoid an audit is to be “accurate, honest, and modest.”

The Comprehensive Taxpayer Attitude Survey (CTAS) Executive Report, dated December 5, 2024, showed that eight in ten taxpayers say it is unacceptable to cheat on one’s taxes. The top three reasons to report and pay honestly include personal integrity, the potential to receive a refund, and avoiding paying interest/penalties.

Audit triggers

Kiplinger’s reports these red flags that might increase the risk of an audit:

- Failing to report all taxable income.

- Making a lot of money.

- Non-filers (especially high-income earners).

- Taking higher-than-average deductions, losses, or credits.

- Taking large charitable deductions (in comparison to income).

- Running a business (filing Schedule C).

- Writing off what sounds like a hobby loss (using Schedule C).

- Failing to report certain professional earnings as self-employment income.

- Claiming rental losses.

- Claiming refundable tax credits.

- Taking an early payout from an IRA or 401(k).

- Taking an alimony deduction.

- Failing to report gambling winnings or claiming big gambling losses.

- Claiming the foreign earned income exclusion.

- Operating a marijuana business.

- Taking the research and development (R&D) credit.

- Engaging in virtual currency or other digital asset transactions.

- Failing to report a foreign bank account.

Additional triggers include the following:

- Suspiciously round numbers that end in zero or five.

- Misreported income.

- Excessively large charitable gifts.

- Claiming home office expenses.

- Using a personal car for business.

- Commingling business and personal expenses.

- Claiming the first-time homebuyer credit between 2008 and 2011.

- Having several years of missing tax returns.

What to do if audited

You will never experience a surprise audit; notification is primarily through mail. Failure to respond within a certain time period could result in penalty charges or additional interest. So acknowledge it, respond, then gather necessary information. The IRS can flag earlier filings, but they typically do not go back more than three years for personal matters and six years for businesses. For more audit information, check the IRS website. For an immediate action plan, see here.

Here are some different types of audits:

- Correspondence audit — handled via letters, documents, or clarification for deductions.

- Office audit — requires an in-person interview.

- Field audit: may involve an IRA agent visiting your home, business, or accountant’s office for an in-depth review.

If you disagree with your audit results, you can appeal the decision.

Do not fear

An IRS audit is no cause for panic. Honesty, preparation, documentation, and storage of information should alleviate fear and concern. Being able to easily locate and access records is important, along with online log-in information used to file (like TurboTax). If you disagree with an audit decision, you can file an appeal. Storing accurate records, using tax software, or working with a qualified CPA can reduce the possibility of future audits.

“Let every person be subject to the governing authorities. For there is no authority except from God, and those that exist have been instituted by God … Therefore, one must be in subjection, not only to avoid God’s wrath but also for the sake of conscience. For because of this you also pay taxes, for the authorities are ministers of God, attending to this very thing. Pay to all what is owed to them: taxes to whom taxes are owed, revenue to whom revenue is owed, respect to whom respect is owed, honor to whom honor is owed” (Romans 13:1, 5–7 ESV).

Do you want more tools and tips on financial stewardship? Are you interested in receiving ministry updates from around the world? Sign up to receive the Crown Newsletter emails by using the form on the homepage at Crown.org.

Chuck Bentley is CEO of Crown Financial Ministries, a global Christian ministry, founded by the late Larry Burkett. He is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Economic Evidence for God?. Be sure to follow Crown on Facebook.